In contrast, a company with a low ratio is more conservative, which might be more suitable for its industry or stage of development. Considering the company’s context and specific circumstances when interpreting this ratio is essential, which brings us to the next question. A higher ratio suggests that the company uses more borrowed money, which comes with interest and repayment obligations. Conversely, a lower ratio indicates that the company primarily uses equity, which doesn’t require repayment but might dilute ownership.

Debt to Equity Ratio Explained

The energy industry, for example, only recently shifted to a lower debt structure, Graham says. If you’re an equity investor, you should care deeply about a firm’s ability to make debt obligations, because common stockholders are the last to receive payment in the event of a company liquidation. The debt-to-equity ratio also gives you an idea of how solvent a company is, says Joe Fiorica, head of Global Equity Strategy at Citi Global Wealth. “Solvency refers to a firm’s ability to meet financial obligations over the medium-to-long term.” In nutrition science, there’s a theory of metabolic typing that determines what type of macronutrient – protein, fat, carbs or a mix – you run best on. It can tell you what type of funding – debt or equity – a business primarily runs on.

Q. Are there any limitations to using the debt to equity ratio?

- Tesla had total liabilities of $30,548,000 and total shareholders’ equity of $30,189,000.

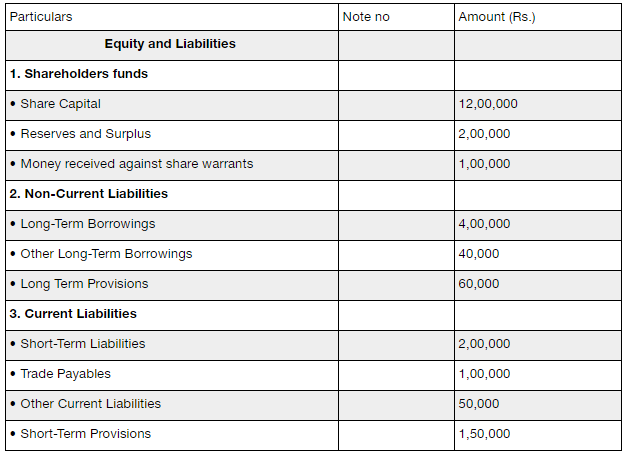

- Here, “Total Debt” includes both short-term and long-term liabilities, while “Total Shareholders’ Equity” refers to the ownership interest in the company.

- The remaining long-term debt is used in the numerator of the long-term-debt-to-equity ratio.

- Another popular iteration of the ratio is the long-term-debt-to-equity ratio which uses only long-term debt in the numerator instead of total debt or total liabilities.

- Investors can use the D/E ratio as a risk assessment tool since a higher D/E ratio means a company relies more on debt to keep going.

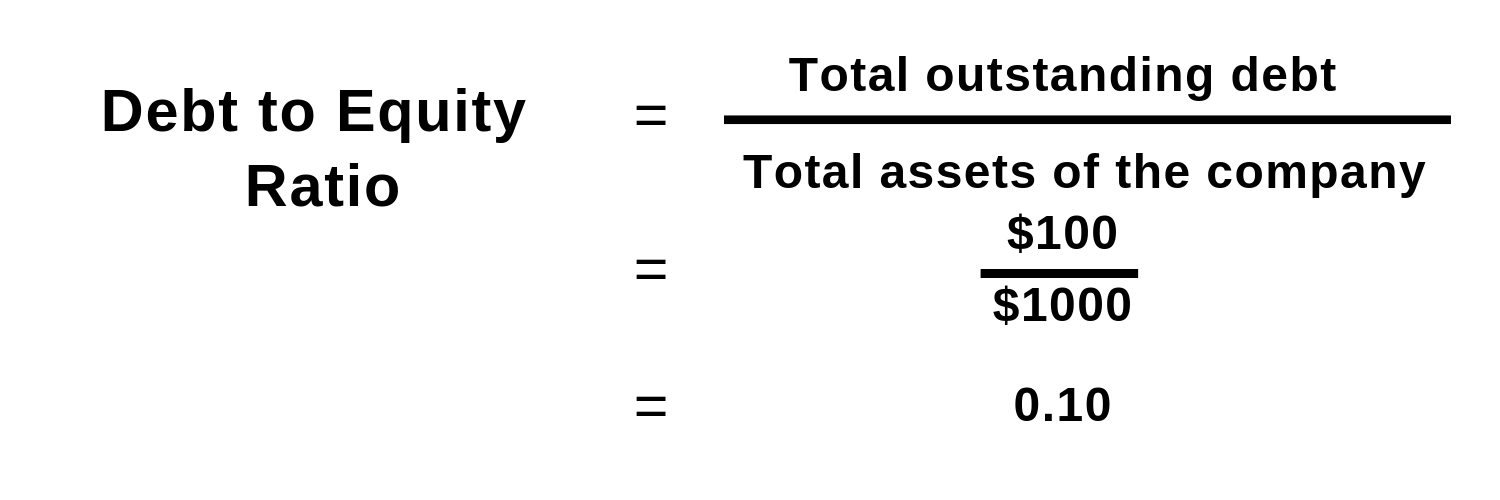

Divide $100 million by $85 million and you’ll see that the company’s debt-to-equity ratio would be about 1.18. What counts as a good debt ratio will depend on the nature of the business and its industry. Generally speaking, a debt-to-equity or debt-to-assets ratio below 1.0 would be seen as relatively safe, whereas ratios of 2.0 or higher would be considered risky. Some industries, such as banking, are known for having much higher debt-to-equity ratios than others. A debt ratio greater than 1.0 (100%) tells you that a company has more debt than assets. Meanwhile, a debt ratio of less than 100% indicates that a company has more assets than debt.

Debt to Equity Ratio Formula (D/E)

The long-term D/E ratio for Company A would be 0.8 vs. 0.6 for company B, indicating a higher risk level. Including preferred stock in total debt will increase the D/E ratio and make a company look riskier. Including preferred stock in the equity portion of the D/E ratio will increase the denominator and lower the ratio. This is a particularly thorny issue in analyzing industries notably reliant on preferred stock financing, such as real estate investment trusts (REITs). As a highly regulated industry making large investments typically at a stable rate of return and generating a steady income stream, utilities borrow heavily and relatively cheaply.

Debt Ratio

The D/E ratio represents the proportion of financing that came from creditors (debt) versus shareholders (equity). Publicly traded companies that are in the midst of repurchasing stock may also want to control their debt-to-equity ratio. That’s because share buybacks are usually counted as risk, since they reduce the value of stockholder equity. As a result the equity side of the equation looks smaller and the debt side appears bigger.

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses.

Debt-financed growth may serve to increase earnings, and if the incremental profit increase exceeds the related rise in debt service costs, then shareholders should expect to benefit. However, if the additional cost of debt financing outweighs the additional income that it generates, then the share price may drop. The cost of debt and a company’s ability to service it can vary with market conditions. As a result, borrowing that seemed prudent at first can prove unprofitable later under different circumstances. The debt-to-equity ratio is a financial ratio that measures how much debt a company has relative to its shareholders’ equity. It can signal to investors whether the company leans more heavily on debt or equity financing.

Total debt represents the aggregate of a company’s short-term debt, long-term debt, and other fixed payment obligations, such as capital leases, incurred during normal business operations. To accurately assess these liabilities, companies often create a debt schedule that categorizes liabilities into specific components. Understanding the debt to equity ratio is essential for anyone dealing with finances, whether you’re an investor, a financial analyst, or a business owner. It shines a light on a company’s financial structure, revealing the balance between debt and equity. It’s not just about numbers; it’s about understanding the story behind those numbers. In a basic sense, Total Debt / Equity is a measure of all of a company’s future obligations on the balance sheet relative to equity.

Because banks borrow funds to loan money to consumers, financial institutions usually have higher debt-to-equity ratios than other industries. A steadily rising D/E ratio may make it harder for a company to obtain financing in the future. The growing reliance on debt could eventually lead to difficulties in servicing the company’s sick pay from day one for those affected by coronavirus current loan obligations. If a company has a negative D/E ratio, this means that it has negative shareholder equity. In most cases, this would be considered a sign of high risk and an incentive to seek bankruptcy protection. This ratio indicates how much debt a company is using to finance its assets compared to equity.

However, if that cash flow were to falter, Restoration Hardware may struggle to pay its debt. Investors can use the D/E ratio as a risk assessment tool since a higher D/E ratio means a company relies more on debt to keep going. The interest paid on debt also is typically tax-deductible for the company, while equity capital is not. Ultimately, businesses must strike an appropriate balance within their industry between financing with debt and financing with equity. In addition, there are many other ways to assess a company’s fundamentals and performance — by using fundamental analysis and technical indicators. Gearing ratios focus more heavily on the concept of leverage than other ratios used in accounting or investment analysis.