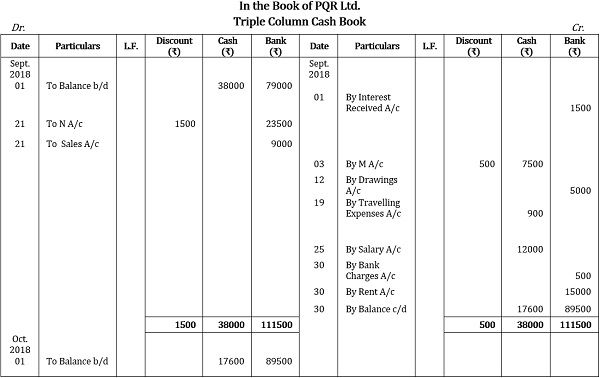

The three column cashbook uses three columns on each side of the book. This format in effect combines both two column formats discussed above in that it uses the additional columns to record both discounts and bank account transactions. A contra entry is when an entry is made on the debit side and the same entry is recorded on the credit side of the cash book. A bank account may have an overdrawn balance because by arranging an overdraft with the bank, it is possible that more money may be withdrawn from the bank than what was deposited. If the debit column is larger than the credit column, the difference represents cash at bank. If, on the other hand, the credit column exceeds the debit column, the difference represents “overdrawn balance”.

Single Column Cash Book

The total of discount column on credit side represents the total cash discount received from suppliers during the period and is posted to the discount received account maintained in the ledger. The cash and bank columns of triple column cash book are used as accounts and are periodically totaled and balanced just like in case of a double column cash book. A cash book is a subsidiary book that includes both cash and bank transactions, and it is a journal and a ledger.

Just a Few More Details

It is calculated on invoices and is not recorded in the double entry books of account. It is provided due to business consideration such as trade practices, bulk orders and market competition. An original entry in a cash book is a record of a financial transaction. When recording transactions in a cash book, many things need to be considered.

What is the source of cash book entries?

While there are multiple advantages to using a cash book, disadvantages exist too. A cash book is a financial journal that contains all cash receipts and disbursements, including bank deposits and withdrawals. This is the main area where businesses record any and all cash-related information. The first three columns are the same as the single column cashbook and show the date, transaction description (Desc.), and ledger folio reference (LF).

- Single-column cash books (also called simple-column cash books) show cash entries received (receipts) on the left side or the debit side.

- A triple column cash book is the most complex type of cash book.

- The entries about bank transactions and ledgers are on separate ledgers.

- It is worth mentioning that the format of a three column cash book is similar to that of a two column cash book.

On the other hand, if debtors pay early, a discount may be allowed to them. A bank statement refers to the list of entries to each account holder that have been made in their personal account, which is maintained by the bank. When the bank pays out cash against that cheque, it records the payment on the debit column of his statement of account. The three common types of cash books are single-column, double-column, and triple-column. The first line of each entry shows date, name of customer (if any), account to be debited (positive amount) or credited (negative amount). Trade discount is a reduction in the list price of goods by a manufacturer/wholesaler to another business.

Would you prefer to work with a financial professional remotely or in-person?

Businesses use cash books to remain aware of their position with banks, while banks maintain records to ensure their position with an account holder is known. Single-column cash books (also called simple-column cash books) show cash entries received (receipts) on the left side or the debit side. In contrast, the right side or credit side contains cash payments.

The cash ledger book can act as both a journal and a ledger and comes in various formats. In a keep these tips in mind when filing small business taxes, three columns are provided for the amounts on each side. One column records cash receipts and payments, the second records banking transactions, and the third records discounts received and allowed. Most business owners today use accounting software to maintain books. However, knowing how to balance a cash book is still beneficial.

John is allowed a further cash discount of 8% for prompt payment. A detailed cash book has its own unique way of recording transactions. Keep reading to learn which type would make the most sense for you or your business. The cash book is updated from original accounting source documents, and is therefore a book of prime entry and as such, can be classified as a special journal. The following example summarizes the whole explanation of the triple-column cash book given above.